Money flows into commercial space stations, logistics, and lunar exploration are lagging.

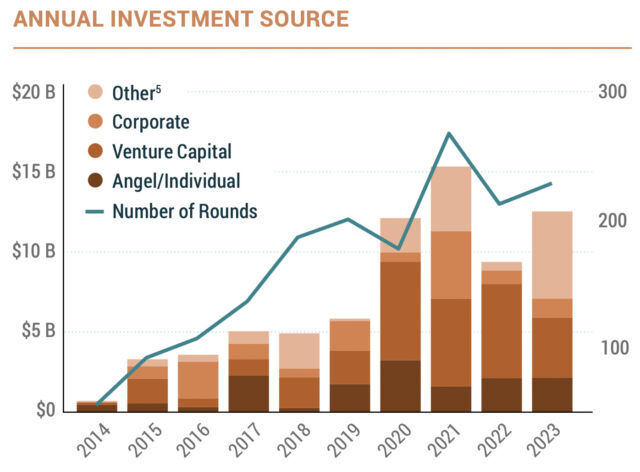

Private investors pumped $12.5 billion into space companies last year, around 30 percent more than the year before, but still shy of the space investment boom of 2021.

This is welcome news for cash-hungry startups in the space sector, but investors are becoming more diligent about where they put their money. This has led to a consolidation frenzy, with space companies merging or acquiring one another. And more investors are choosing not to prop up unsuccessful companies, meaning some firms will be doomed to fail.

The latest figures on global private investment come from Space Capital, a venture capital shop that exclusively invests in the space industry. Space Capital publishes a quarterly report outlining trends across several space industry sectors, including infrastructure, applications, distribution, and emerging markets.

Most space companies with familiar names fall under infrastructure. In this category, companies received $12.5 billion in private investment last year, up from $9.3 billion the year before but still shy of the record of $15.3 billion in 2021. One thing that stands out is most of this money in 2023 didn’t come from billionaire founders at the helm of SpaceX, Blue Origin, or Virgin Galactic. Instead, capital flowed from venture capital firms, private equity, foundations, or sovereign wealth funds.

A few years ago, numerous privately held space companies went public through the Special Purpose Acquisition Company (SPAC) process as a way to access public capital markets. But a crash soon followed the SPAC craze, and the companies that went public through the SPAC process suffered.Advertisement

Some, like the launch company Astra and the in-space logistics startup Momentus, appear to be on their last legs after initial valuations of more than $1 billion when they went public. Today, only Rocket Lab is close to having a market value even half as high as measured three years ago. This may have quelled investors’ appetites to put money into space companies. Higher interest rates put in place to stave off inflation also put a damper on private investment across all industries.

Forecasting 2024

The prospect of declining interest rates could steer more private capital into the space industry in 2024. There’s also a higher demand than ever for space services, such as broadband communications, with satellites for mega-constellations like SpaceX’s Starlink, Amazon’s Kuiper, and China’s Guowang Internet networks either launching regularly or soon to reach the launch pad.

“While 2023 posed challenges for tech startups generally, areas of the space economy remained resilient,” wrote Chad Anderson, founder and managing partner of Space Capital. “2024 holds even more potential, with ambitious plans for direct-to-cellular SatCom (satellite communications) expansion, AI integration, increased government funding, and a growing appetite for investment.”

The British venture firm Seraphim Space agrees with Anderson’s prediction.

“We foresee this positive trend extending throughout 2024, buoyed by an overall improvement in market conditions,” Seraphim Space’s US subsidiary, Generation Space, wrote in a market outlook for this year. “We predict that 2024 will be another year of record numbers of SpaceTech companies being funded, with both early and growth stage investment activity increasing.”

It could be another year of shake-ups for commercial space companies, with consolidation most likely in the communications and Earth observation sectors, according to Generation Space. In 2023, there were 39 merger and acquisition deals in the space industry, more than in any other year in the last decade. These deals included the merger of Eutelsat and OneWeb, Viasat’s acquisition of Inmarsat, and L3Harris buying out Aerojet Rocketdyne.

“Anticipating robust activity in mergers and acquisitions throughout 2024, we foresee a continuation of strategic moves from incumbents, ‘New Space’ leaders, and private equity players,” Generation Space said.

Investing in a sure thing

Companies focusing on satellite manufacturing and launch are most attractive to private investors. Satellite companies received $6.1 billion in investment last year, compared to $4.4 billion for launch companies. Collectively, satellite and launch companies accounted for 84 percent of the private money funneled into space infrastructure businesses last year, in line with trends over the last 10 years.

This makes sense for a couple of reasons. First, satellite manufacturing and launch services are mature markets. There’s higher volume in these areas, with the proliferation of small satellites and dozens of companies around the world either developing or flying launch vehicles. There are simply more targets for venture capital or equity funds to invest in.

Second, there’s a fairly predictable government demand for launch services and satellite manufacturing. Civilian space agencies and militaries are buying more satellites than ever, and those spacecraft will need more rockets to get into orbit. There was a record number of orbital launches last year—212 worldwide—with SpaceX accounting for nearly half the total.

“In the quest for revenue in this challenging market, more companies are chasing government dollars and more investors are willing to fund them,” Anderson wrote. “At the same time, world governments are beginning to recognize that space-based assets are essential for economic stability and national security. The US Department of Defense (DoD) is rearchitecting its approach to space to rely on commercial space services.”

The US military’s spending on space assets and services is surely to only go up as the Pentagon readies itself for a potential conflict with China.

Meanwhile, investment into emerging markets in space continues to lag far behind launch and satellite manufacturing. We write a lot about these emerging markets because they’re exciting and new—commercial space stations, in-space logistics and servicing, in-space manufacturing, and privately funded lunar missions.Advertisement

Combined, these market sectors accounted for $2 billion in private investment last year. Commercial space stations led the group at approximately $900 million, followed by in-space logistics (space tugs and satellite servicing), lunar exploration, and “industrials” focusing on manufacturing things in space.

One characteristic of these emerging markets is that they generally rely more on government support. NASA would be an anchor customer for a commercial outpost to replace the International Space Station in low-Earth orbit, and the agency has contracts with several commercial teams working on this. Similarly, NASA’s Commercial Lunar Payload Services (CLPS) program is geared toward fostering a commercial lunar economy. The idea: The government creates an initial demand for these services, and commercial businesses will follow.

Speaking in October, Anderson raised questions about the size of the market for commercial space stations outside of NASA. He forecasts a bigger market in the lunar and logistics sectors.

“It’s fascinating for me to sort of look at those numbers and see the discrepancy, the dislocation, between investors and what they’re thinking, and where the actual market is,” Anderson said.

So, who got the most money?

Blue Origin received the highest level of private investment among space infrastructure companies in the second half of last year, at an estimated $1 billion. This all came from Jeff Bezos, Blue Origin’s billionaire founder, who reportedly infuses his space company with $2 billion per year to fund the New Shepard suborbital rocket, the orbital-class New Glenn launcher, a commercial lunar lander for NASA, and an engine development unit.

Axiom Space, a Houston-based company with plans for a commercial space station, raked in $350 million, good enough to rank second in private fundraising in the latter half of 2023. Firefly Aerospace was in third place after raising $300 million in private capital in a fundraising round that closed in November. Firefly operates the light-class Alpha rocket and is developing a medium-class launcher, a commercial cargo lander for the Moon, and a space tug.

Other companies that boasted significant fundraising rounds in the second half of last year included Sierra Space, a spacecraft manufacturer with a toehold in the commercial space station market, and Galactic Energy, a Chinese startup launch company.

No surprise, Space Capital reported that SpaceX was the world’s most valuable privately held space infrastructure company at the end of 2023, at $150 billion. Blue Origin, Maxar Technologies, Sierra Space, Relativity Space, Axiom Space, and Astranis round out the top seven.