Data center revenue is up 279% from the same quarter last year.

Most Ars readers still probably know Nvidia best for its decades-old GeForce graphics cards for gaming PCs, but these days Nvidia’s server GPU business makes GeForce look like a hobby project.

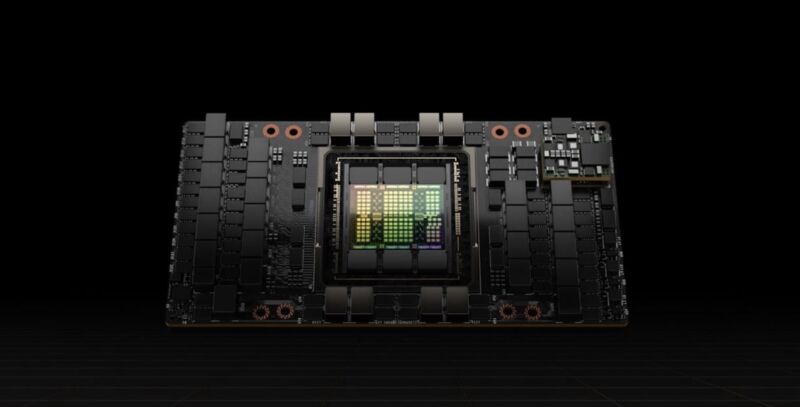

That’s the takeaway from Nvidia’s Q3 earnings report, which shows Nvidia’s revenue up 206 percent from the same quarter last year and 34 percent from an already-very-good Q2. Of the company’s $18.12 billion in revenue, $14.51 billion was generated by its data center division, which includes AI-accelerating chips like the H200 Tensor Core GPU as well as other cloud and server offerings.

FURTHER READING

For Nvidia, it’s AI or bust as it reports a record-breaking quarter

And though GeForce revenue was a much smaller $2.86 billion, this was still a solid recovery from the same quarter of Nvidia’s fiscal 2023, when GeForce GPUs earned just $1.51 billion and were down 51 percent compared to fiscal 2022. Nvidia has released several new mainstream GeForce RTX 40-series GPUs this year, including the $299 RTX 4060. And while these more affordable GPUs aren’t staggering upgrades from previous-generation cards, Steam Hardware Survey data shows the RTX 4060 and 4060 Ti are being adopted pretty quickly, more than can be said of competing GPUs like AMD’s RX 7600 or Intel’s Arc series.Advertisement

The company’s overall revenue numbers weren’t looking nearly this good a year ago, either—in Q3 of fiscal 2023, the company’s revenue had fallen 17 percent year over year. The quarter before that, the company missed its own projections by $1.4 billion due to an oversupply of GPUs and a crypto-mining crash that reduced sales.

Demand for Nvidia’s AI-accelerating GPUs probably won’t be as volatile as demand for cryptomining GPUs was. For starters, there are big companies with big money buying up just about every HGX GPU that Nvidia can make, and companies like Microsoft and Amazon continue to make major AI announcements and investments at a steady clip—Nvidia also said it’s partnering with Dropbox, Foxconn, Lenovo, and multiple other companies on various AI initiatives. And, just as in PC and workstation graphics cards, Nvidia’s dominance can beget more dominance as software tools are designed for and optimized for Nvidia’s chips first.

Still, the crypto-mining example is instructive. If this bubble bursts, or if competing products from AMD or Intel begin making a dent in Nvidia’s sales, Nvidia could be in for a rough few quarters as these stratospheric revenue numbers come back to earth. Nvidia has also had trouble selling its AI chips in China, where US export restrictions on some high-performance chips have caused Nvidia to modify or stop offering some of its products to meet requirements.

Nvidia’s workstation GPUs and automotive divisions also grew year over year, though, at $416 million and $261 million, respectively, both divisions contribute a lot less to Nvidia’s bottom line than the data center or GeForce products.