Local competition, surge of BEVs, and security-related restrictions lead to changes.

Apple and Tesla cracked China, but now the two largest US consumer companies in the country are experiencing cracks in their own strategies as domestic rivals gain ground and patriotic buying often trumps their allure.

Falling market share and sales figures reported this month indicate the two groups face rising competition and the whiplash of US-China geopolitical tensions. Both have turned to discounting to try to maintain their appeal.

A shift away from Apple, in particular, has been sharp, spurred on by a top-down campaign to reduce iPhone usage among state employees and the triumphant return of Chinese national champion Huawei, which last year overcame US sanctions to roll out a homegrown smartphone capable of near 5G speeds.

Apple’s troubles were on full display at China’s annual Communist Party bash in Beijing this month, where a dozen participants told the Financial Times they were using phones from Chinese brands.

“For people coming here, they encourage us to use domestic phones, because phones like Apple are not safe,” said Zhan Wenlong, a nuclear physicist and party delegate. “[Apple phones] are made in China, but we don’t know if the chips have back doors.”Advertisement

Wang Chunru, a member of China’s top political advisory body, the Chinese People’s Political Consultative Conference, said he was using a Huawei device. “We all know Apple has eavesdropping capabilities,” he said.

Delegate Li Yanfeng from Guangxi said her phone was manufactured by Huawei. “I trust domestic brands, using them was a uniform request.”

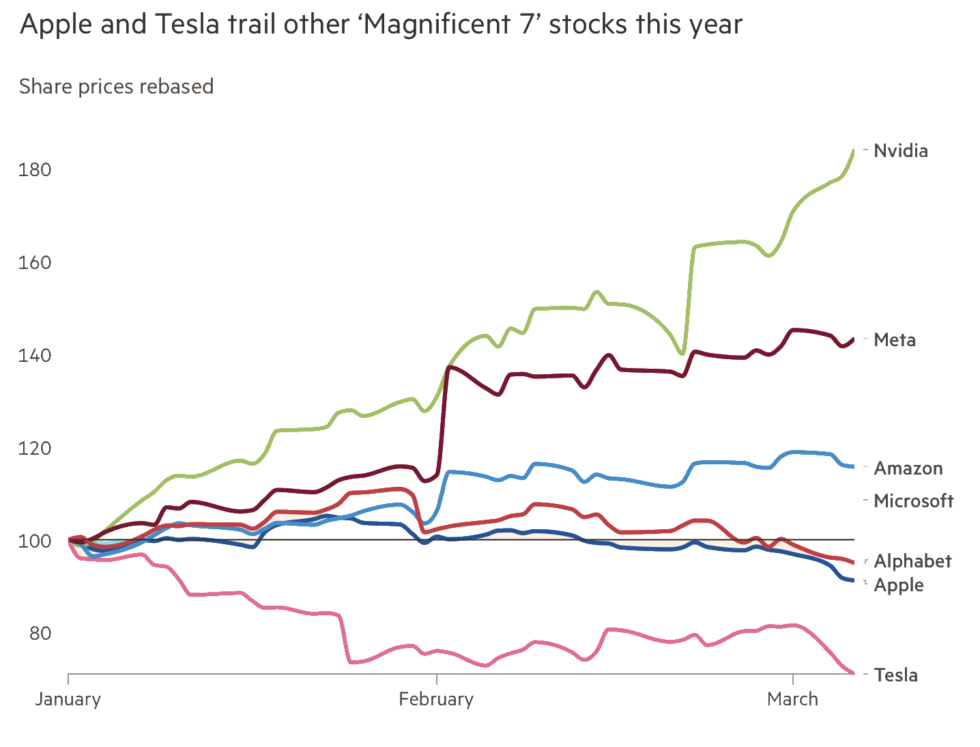

Outside of the US, China is both Apple and Tesla’s single-largest market, respectively contributing 19 percent and 22 percent of total revenues during their most recent fiscal years. Their mounting challenges in the country have caught Wall Street’s attention, contributing to Apple’s 9 percent share price slide this year and Tesla’s 28 percent fall, making them the poorest performers among the so-called Magnificent Seven tech stocks.

Apple and Tesla are the latest foreign companies to feel the pain of China’s shift toward local brands. Sales of Nike and Adidas clothing have yet to return to their 2021 peak. A recent McKinsey report showed a growing preference among Chinese consumers for local brands.

Apple has lost share in the high-end phone market to Huawei, which unveiled a powerful smartphone powered by a homegrown processor in August last year, the Mate 60 Pro.

Meanwhile, a campaign to rid state agencies of Apple phones, which kicked into high gear last summer, has picked up speed.

Guo, who works at a government-affiliated think-tank and who asked that only his surname be published, said his office received the order late last year. “They gave us a deadline with a month and day by which we would have to stop using iPhones.”

“They didn’t give us any subsidies, instead one day Huawei people came into our office with boxes of phones to sell, all 20 percent off,” he said. “Our whole building was fighting to get the phones.”

Nong Jiagui, a teacher in rural Yunnan province, said educators faced similar requests. “Schools are told to use Chinese phones as well, to support Chinese companies,” he said.

For some ordinary consumers, patriotism has spurred a switch. Liu, who asked that his first name be withheld, swapped his iPhone for Huawei’s new Mate 60 in October. “I’ve been waiting for a long time for a phone with a real domestically produced chip so I put down my iPhone and am supporting Huawei!” he gushed.

Data from research group Counterpoint shows that in the first six weeks of this year, Apple smartphone sales fell 24 percent from a year earlier. Huawei sales, by contrast, were up 64 percent.

Weakening Chinese demand was apparent in Apple’s fourth-quarter sales, with China revenues unexpectedly down 13 percent from a year earlier. Chief executive Tim Cook last month told analysts he remained “very optimistic about China over the long term” and blamed part of the decline on a stronger dollar.

He has spent years tying the company’s fortunes to China and built a supply chain that is heavily dependent on factories in Shenzhen and Zhengzhou—although the company is now trying to diversify manufacturing and production to countries such as India.Advertisement

Facing a tougher market, Apple and its retailers have begun discounting. “Sales growth is increasingly reliant on promotional activities and price cuts,” said Ivan Lam, a senior analyst at Counterpoint.

Tesla has repeatedly returned to such a strategy to maintain sales in the country. The US electric-vehicle maker most recently offered incentives worth as much as Rmb34,600 ($4,800) to lure Chinese consumers to purchase Model 3 sedans and Model Y sport utility vehicles.

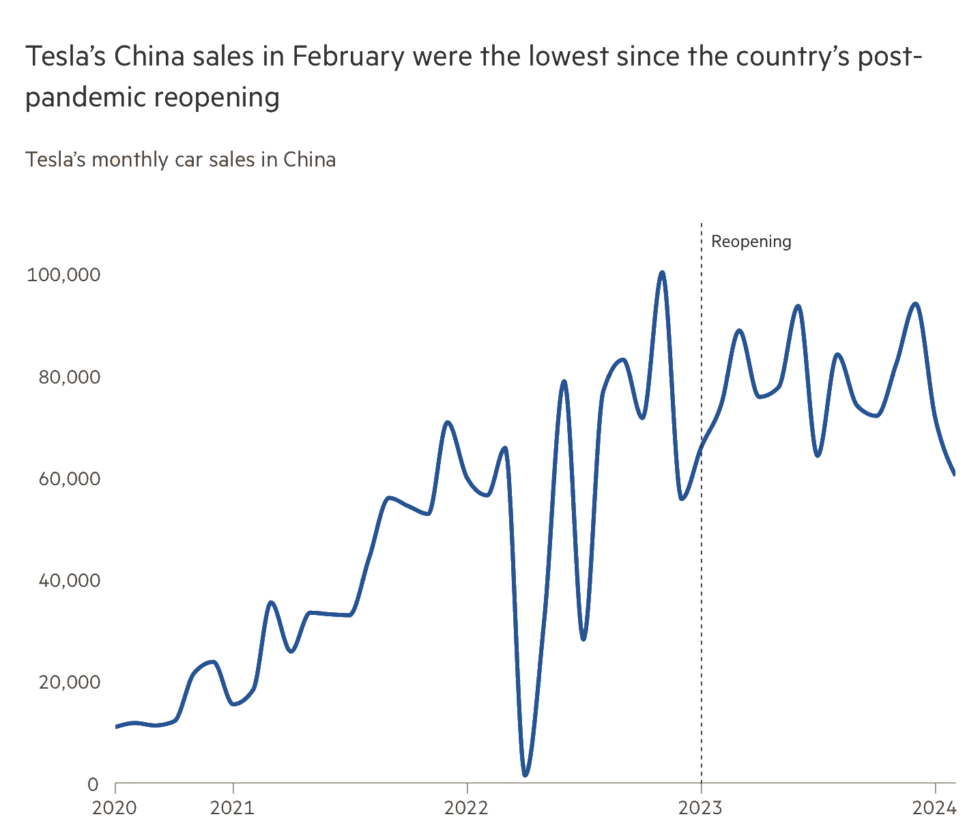

While Tesla sales remained solid in the country last year, the company faces a brutal price war and early signs of slowing growth in demand. In the first two months of the year, Tesla’s market share of China’s new energy vehicle sales, which include EVs and hybrid plug-ins, slipped to 6.6 percent, from 7.9 percent in the same period a year earlier, according to the China Passenger Car Association. Tesla China did not immediately respond to a request for comment.

Its bottom line in China is also set to take a hit this year as it loses a 15 percent preferential tax rate, which remains available to many of its local competitors. Shanghai’s state-owned carmaker SAIC Motor, for example, had its 15 percent tax rate for being a “high-tech enterprise” renewed four times since 2008.

Tesla drivers also have to put up with a growing number of no-go zones for their vehicles. They include places such as military and government complexes over concerns that in-cabin devices on Tesla vehicles could collect sensitive data—a concern about Chinese smart cars also expressed by the Biden administration.

Daniel Kollar, an automotive expert at consultancy Intralink, said Tesla’s China performance had remained strong but the company faced challenges from local competition, a renaissance of hybrid cars, and security-related restrictions. “There are a lot of local alternatives to choose from in this space,” he said.

Additional reporting by Edward White in Shanghai