New apps reportedly make median monthly revenue of less than $50.

Mobile app developers are expected to push subscriptions more aggressively over the next year. Numbers that RevenueCat recently shared examining over 30,000 apps suggest why: Most apps struggle to reach $1,000 per month in revenue.

RevenueCat makes a subscription toolkit for mobile apps. The 7-year-old company’s study shared today, as spotted by TechCrunch, said the firm examined apps using its in-app subscription SDKs. RevenueCat’s report didn’t list all apps studied but claims Reuters, Buffer, Goodnotes, PhotoRoom, and Notion as customers. The report claims that 90 percent of apps with an in-app-subscription platform use RevenueCat. The San Francisco-based company also claims to support “everything from niche indie apps to several of the top 100 subscription apps,” which notably suggests that most of the top-100 subscription apps aren’t included in this study.

With these caveats in mind, the 120-page report still provides unique details about a claimed $6.7 billion in subscription revenue touching over 18,000 developers and 290 million subscribers using the Apple App Store and Google Play Store.

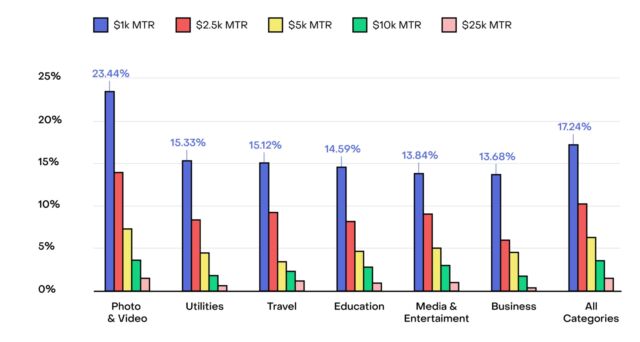

According to RevenueCat, about 17 percent of the apps examined make at least $1,000 each month. The percentage of examined apps making more monthly revenue is even lower:

RevenueCat noted that once apps do reach $1,000/month in revenue, they’re more likely to make $2,500 in monthly revenue (59 percent of apps that reached the $1,000 mark reportedly did) or even $5,000/month in revenue (60 percent of the apps that reached $2,500/month in revenue reportedly did).

Imbalanced revenue

RevenueCat’s numbers point to a strong imbalance in revenue share among mobile subscription apps: The report found that 12 months after launching, the top 5 percent of apps make over 200 times the revenue of the bottom quartile. For new apps, the median monthly revenue after one year is “a little under $50.”Advertisement

“When segmenting down to the top 10 percent or even top 5 percent of performers, revenue numbers increase rapidly, going from $223 (upper quartile) to $971 (Q90), to $2,352 (Q95) in monthly revenue,” the report says.

Still, with advertising spending continuing to tumble and developers looking for a way to generate recurring revenue to support app maintenance, support, and advancements, subscriptions are expected to continue being developers’ primary strategy. RevenueCat’s study quoted Ariel Michaeli, co-founder and CEO of mobile app developer reporting platform Appfigures, as saying that company data found that 59,000 new subscription-based apps came out in 2023.

Subscription fatigue

Challenges in mobile app subscriptions include not only convincing people to pay for an app but also convincing them to do so repeatedly. RevenueCat said that compared to its 2023 report, the portion of monthly subscribers retained after one year declined by 14 percent, “impacting both the best and worst performers alike.” Other insights include monthly subscriptions having a median first renewal rate of over 60 percent but maintaining only 36 percent of the original batch of subscribers by the time it’s time for a third renewal.

Mobile-app developers hoping for recurring dollars are appealing to a user base increasingly deterred by subscription fatigue. According to a 2022 report from management consulting firm Kearney, 42 percent of consumers “think they have too many subscriptions.” But while more industries are focusing on subscriptions, mobile apps, some argue, are a use case where recurring payments make more sense than in other businesses, like printers.

“For the products that sit in a truly recurring use case, this can be a win-win for the consumers and the business. The longer that someone wants to use the product or service that you provide, the bigger the business you can build,” Dan Layfield, founder of Subscription Index, a subscription monetization consulting firm, said in RevenueCat’s report.

Higher prices

Mobile app subscription rates are expected to increase over the next year. The average monthly rate increased 14 percent, from $7.05 to $8.01, in the year since RevenueCat’s 2023 report. Concerns like growing customer acquisition costs, interest in looking like a premium app, and AI could economically challenge mobile-app developers and affect pricing.

But RevenueCat also expects that over the next year, devs will experiment more with other revenue streams, like in-app purchases and affiliate marketing.