Cars deemed unfixable in North America are resurrected in Eastern Europe.

This summer, a Vancouver car mechanic named Max got a perplexing ping on his phone: Betty White was in Ukraine and needed his help. This was surprising because she had died on a Canadian highway back in January.

When Max last saw Betty White, his nickname for his Tesla Model Y Performance, they were both in rough shape after getting sideswiped on the highway. Max’s rotator cuff was torn in several places. The small SUV had bounced off multiple concrete barriers at high speed and was bashed in on all four corners, its wheels ripped to pieces. Coolant appeared to be leaking into the battery chamber. From his own work on EVs in the garage, Max knew that Betty was done for. “No auto shop would put a repair person at risk with that kind of damage,” says Max, whose last name isn’t being used out of doxing concerns. A damaged EV battery can become dangerous due to the risk of shocks, fire, and toxic fumes. His insurer agreed, and Betty was written off and sent to a salvage yard.

Months after he had last seen the car, Max’s Tesla app was now telling him that Betty needed a software update. It showed the car with an extra 200 kilometers on the odometer, fully charged, and parked in Uman, a town in Ukraine’s Cherkasy Oblast, midway between Kyiv and the front line with Russia’s invasion force. Minutes after that first ping, the app showed the car in service mode, suggesting Betty was undergoing repairs. “I thought it must be a mistake,” Max says.

There was no mistake. WIRED tracked Betty down to a Ukrainian auto auction website, looking good as new, maybe even better, with newly tinted windows and rearview mirrors wrapped in black. Betty 2.0 was being sold by “Mikhailo,” who wrote that the car had suffered “a small blow” in Canada and been repaired with original Tesla parts. The price, $55,000, was roughly the same as a new Model Y Performance costs in the US.Advertisement

Betty White’s intercontinental resurrection was impressive but not unusual. For a long time, cars written off in North America have found their way to Eastern European repair shops willing to take on damage that US and Canadian mechanics won’t touch. In 2021, the most recent data available, Ukraine was a top-three destination for used US passenger vehicles sent overseas, close behind Nigeria and the United Arab Emirates. And Ukraine’s wreck importers and repairers are particularly known for their ingenuity. Some have made fixing EVs written off across the Atlantic into a specialty, helping to drive a surge in the number of electric vehicles on the country’s roads, even as the war with Russia rages.

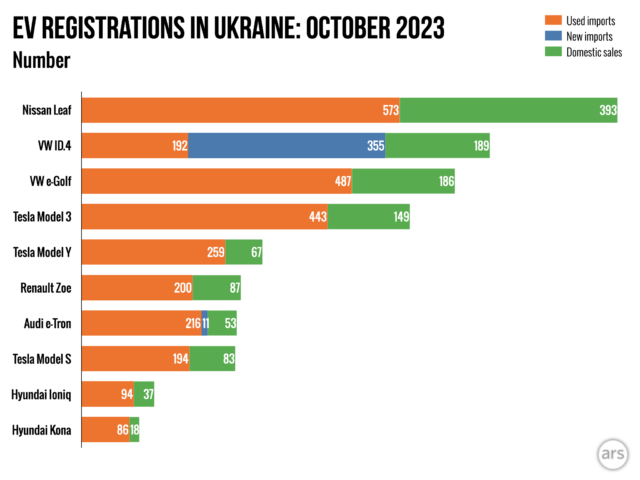

Though few automakers sell new EVs in Ukraine, the share of newly registered vehicles that are fully electric, 9 percent, is about the same as in the US and nearly double that of neighboring Poland and the Czech Republic. Most of Ukraine’s refurbished EVs come from North America, and many arrive with major damage.

There’s a ready supply of crashed North American EVs in part because electrics are becoming more common, and also because in recent years, relatively new EVs with low mileage have been written off at a higher rate than their gas-powered equivalents, according to data from insurers. US and Canadian repair shops and insurers see them as more dangerous and difficult to fix. Scrapyards find it hard to make money from their parts and instead ship them abroad.

A hundred Teslas per month

Ivan Malakhovsky is not afraid to work on cases like Betty White. His 5-year-old repair business in Dnipro, in eastern Ukraine, fixes about 100 Teslas a month, roughly a fifth of them from overseas, and employs a staff that varies between six to 10 people. He’s currently away from home, serving with the Armed Forces of Ukraine, but he manages his workers, and sometimes makes software-mediated repairs, remotely. “We have problems in our lives and can fix them, whether a battery or a full-scale invasion,” says Malakhovsky. “Electric cars, electric car batteries—it’s no problem.”Advertisement

An electric vehicle battery is made up of thousands of individual cells, which store and release energy. Sometimes, Malakhovsky says, he and his coworkers will break up large EV batteries damaged beyond repair and repurpose the cells to power electric scooters or even drones for the war effort. He says the vast majority of Teslas on Ukrainian roads were once involved in wrecks in North America.

The war has even boosted Ukraine’s EV resurrection business at times, by driving up gas prices and making electrics more attractive to drivers. Ukraine has a public charging network of some 11,000 chargers, according to Volodymyr Ivanov, the head of communications at Nissan Motor Ukraine—that’s more than the state of New York, and double the number in neighboring Poland. Since 2018, Ukraine’s government has removed most taxes and customs duties on used EV imports. In the US, electric vehicles tend to be expensive, and the average EV driver is still a high-income male homeowner. North American wrecks, Ukraine’s EV incentives, and its relatively low electricity prices have created a different picture.

“There is a joke here that all poor people are driving electric cars, and all the rich people are driving petrol cars,” says Malakhovsky. “Tesla is a common-people, popular car because it’s very cheap in maintenance.”

That’s a relatively recent development, says Hans Eric Melin, head of Circular Energy Storage, a UK-based consultancy that tracks the international flows of used EVs and batteries. He began watching the Ukraine market in particular a few years ago, after he noticed more ads for Nissan Leafs on auction sites listed in Ukrainian than in English. At the time, the Leaf, a pioneer among EVs, was essentially the only one that had been around long enough to develop a healthy used market. Over time, Ukraine’s electric fleet grew to encompass the full range of EVs sold around the world, including Teslas, as more cars hit the roads and aged or got into crashes.

Melin had suspected Ukraine’s EV boom would end with the war. “I was completely wrong,” he says. By this summer, Ukraine’s EV fleet had doubled since July 2021, to 64,312, according to data compiled by the Automotive Market Research Institute, a Ukrainian research and advocacy group.

When gasoline isn’t the right move

Roman Tyschenko, a 25-year-old IT worker who lives in Kyiv, decided last September that he was sick of his Jeep’s $400-a-month gas bill. Friends had purchased used, damaged electric cars on an online auction website called Copart, a US-based public auto reseller with 200 locations around the world. He logged on and spent $24,000 on a gray 2021 Tesla Model Y that had taken a solid blow to its passenger side in Dallas, Texas. Its bumper was almost fully detached; its hood was tented; some of its airbags had deployed.

That Texan Model Y was likely declared totaled by an insurer. From there, it probably moved to a salvage auction in the US, where licensed exporters, salvage shops, and repairers tried to figure out how much value they could squeeze out of the wreck. The winner, or perhaps the insurer itself, listed the car on Copart, which made it available to anyone around the world who wanted a smashed-up Tesla and was willing to pay for shipping.

If Tyschenko hadn’t brought the Texan Tesla to Ukraine himself, it had a good chance of being shipped there anyway by someone who professionally flips cars to countries like Ukraine. These exporters look for wrecks potentially worth more than their scrap value, but little enough that an expensive US repair and resale wouldn’t make sense. Some ship vehicles directly to Ukrainian repairers and pay for the fix, while others import damaged cars and relist them for sale to Ukrainian buyers who can figure it out for themselves.

It takes a damaged North American car between one and five months to reach a nearby port. Before the war, wrecked cars headed to Ukraine’s Port of Odessa on the Black Sea. Since Russia invaded in 2022, they come through Klaipėda in Lithuania on the Baltic Sea, or Koper in Slovenia on the Adriatic, and are brought to Ukraine by truck. A shop like Malakhovsky’s can fix a Tesla in somewhere between one week and one year, depending on the damage.

Tyschenko arranged for his Model Y to be shipped to a local repair shop in Kyiv, where it arrived in February 2023, five months after he hit the Buy button online. The technician sent him videos of the EV’s ongoing revamp every few weeks, and Tyschenko stopped by to visit a handful of times. By May, he had paid the technician some $25,000 for his work and was driving the Model Y around Kyiv.Advertisement

Two months later, the battery died and Tyschenko spent another $4,000 to replace it—a demonstration of the risks of electric vehicle rescues. Still, he’s happy with how things worked out, and now pays just $10 to $100 a month to refuel his car, depending on whether he charges at home or at public stations.

Finding parts to repair Teslas and other EVs can be a challenge. On Facebook and Telegram, groups like “Renault Zoe Club Ukraine” host thousands of EV owners who barter with each other for spare parts. Oleksandr Perepelitsa, a 25-year-old electric vehicle repairer in Kyiv, says that when he first began his work three years ago, he and his business partners would buy two wrecked Teslas from overseas to create a single working vehicle to sell to local Ukranians. “Even that was profitable for us,” he says. Now, business connections can send Tesla parts from the US or Europe, or repairers buy cheaper Chinese reproductions.

Failure breeds success… on another continent

The success of Ukraine’s EV resurrection industry is the flip side of the failure of insurers and manufacturers in North America to figure out what to do when a shiny new EV becomes roadkill.

US insurers are more willing to write off vehicles of all kinds that in the past may have been fixed. New vehicle repairs have gotten more expensive, in part due to vehicles getting more complex and computerized, as well as a shortage of vehicle technicians. In the past decade, the damaged cars up for auction “are better and less damaged,” Copart CEO Jeff Liaw told investors on an earnings call this year.

Industry-wide data is hard to come by, but numerous sources suggest that EVs are more likely to be written off than gas-powered cars, and can be declared unfixable after even minor crashes. A Reuters analysis this year found that a “large portion” of damaged EVs sold for scrap were low-mileage, nearly-new vehicles. While one in 10 new cars sold in the US and Canada this year are forecasted to be electric, the infrastructure and expertise needed to assess and fix damaged EVs can be patchy. “In an ideal world, electric vehicles are as easy to repair as internal combustion engine vehicles,” says Mark Fry, research manager at Thatcham Research, which crunches auto market data for insurers and other clients. It recently found British EVs get written off at disproportionately high rates.

The main reason EV repairs are so tricky comes down to a lack of agreement on how to handle EV batteries after a crash. Worldwide, there is no industry standard for measuring battery health. Vehicle manufacturers sometimes refuse to sanction battery repairs because of liability concerns. “If you repair the battery, what’s it going to be like after another two, three years and another 50,000 miles?” Fry says. It’s easier to let nearly new vehicles be declared dead than to find out.Advertisement

The North American scrap industry is also somewhat leery of EVs, says Megan Slattery, a researcher at UC Davis who studies what happens to damaged EV batteries. Scrap businesses generally make money by taking cars apart to extract the most valuable widgets to resell. But dismantling a battery takes dedicated workers, equipment, and—most important of all—space, due to the fire risks of storing lithium-ion cells. Many mom-and-pop dismantlers don’t have any of that.

Plus, EVs tend to have simpler drivetrains, with more plastic and large, prefabricated body components that can’t be easily pulled apart. In some electric vehicles, the battery is built directly into the car’s structure, making it especially difficult to dismantle or repair. All of that means that exporters looking to sell to eager buyers abroad have less competition when bidding on totaled cars.

In the US, there’s increasing pressure to keep broken EVs from heading overseas. Regulators are concerned about safety, hoping to better track broken batteries through shipping channels as fears rise of fires sparked by used EVs, including on cargo ships. Another is to avoid dumping e-waste on countries without the means to recycle or repurpose, and instead keep the valuable minerals inside batteries local. Battery recycling startups have received vast amounts of private and public investment—both in Western Europe and the US, with funds from the Inflation Reduction Act—with a promise to help shore up raw material supply chains. But so far, they have received only a trickle of used batteries.

Policies that wind up choking off the export of EV wrecks would in some ways be a shame, Slattery says. More stringent European Union export rules for used cars and EV batteries in particular are one reason why the supply of Teslas to Eastern Europe is so dependent on North American wrecks. Without them, the electric revolution would be much less advanced in places like Ukraine, where US and Canadian write-offs have helped support the emergence of charger networks, trained repair specialists, and a wide familiarity and acceptance that electric propulsion is not just green but also practical.

In North America, there’s a widespread belief that “people don’t want electric vehicles and that it’s just laws and regulations that push us to buy them,” says Melin, the used EV analyst. “There are other markets that want to have electrics.” It’s a testament to a system that is working, Melin adds, that used EVs end up in places like Ukraine, where new models are difficult to come by.

For Max in Vancouver, Betty White’s reappearance overseas did cause some headaches. The car was still logged into his Google, Netflix, and Spotify accounts, potentially allowing the new owners to access his personal data. When he asked Tesla support, he was advised to change his passwords, Max says. (Tesla did not respond to WIRED’s questions.)

But looking back on the crash, and now driving a new Model Y—named Black Betty—Max says his old car’s resurrection is the best possible outcome. “I’m happy to see that Betty White has lived to see another day,” he says.