Toyota is losing out as the world’s largest auto market accelerates its shift to EVs. The Japanese automaker informed dealers that it plans to cut production in China with one of its joint ventures.

As China leads the auto industry’s transition to electric cars, several automakers are being squeezed out of the market.

Japan’s Toyota is the latest victim. Toyota is extending a production cut, initially planned for October and November, by another three months.

Toyota’s joint venture with FAW Group said in a letter reviewed by Reuters, “Production from December to February next year will continue to be reduced by a large amount.”

The letter added that sales to Toyota dealers will be cut to 66,000 in December, 60,000 in January, and 38,000 in February.

The move comes as the company looks to keep up in the “severe market environment” in China. Market leaders like BYD and Tesla have slashed prices all year, making it tough for other legacy automakers to compete.

Toyota pulls back as EVs take over in China

With low-priced EVs like the BYD Dolphin, starting at around $17,500 in China, Toyota and others are being squeezed out of the market.

Toyota has already announced layoffs in the region with another joint venture with China’s GAC. The JVs factory employed around 19,000 people, building models including the bZ4X.

After launching the bZ4X in China last October, the company dropped prices by 15% in February as the electric SUV failed to gain traction.

Toyota’s partnership with FAW launched its first electric sedan, the bZ3, in China earlier this year, hoping to spark demand. However, a recall over the summer derailed its momentum.

The automaker revealed plans in July to have engineers from its three joint ventures in China, BYD, FAW, and GAC, work together on a “Toyota-led development project” as it looks to catch up.

Although Toyota still ranks third after BYD and Volkswagen in auto sales in China, it’s losing market share.

According to data from the China Association of Automobile Manufacturers, Toyota sold 1.26 million cars to dealers through September, down 9% from last year. Meanwhile, BYD’s sales were up 60% during the same period.

Electrek’s Take

Toyota’s hesitancy toward EVs is costing it in the world’s largest auto market. EV makers like BYD and Tesla continue gaining market share while laggards fall further behind.

Top comment by PlotterDepot

Liked by 8 people

China informed all auto manufacturers that they had to sell EVs in 2009 and transition a large % to EV; yet Toyota ignored them

(and GM / Mary tried to lobby against it.)

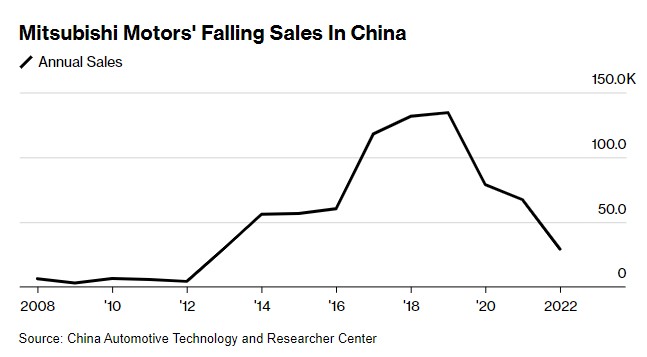

Although the transition has hit Toyota, other Japanese automakers like Nissan, Honda, and Mitsubishi are feeling the impacts even more.

Mitsubishi suspended its business in China after sales fell from over 134,500 in 2019 to only 34,500 this past year.

Nissan’s sales plummeted 20% last year, dropping it out of the top five automakers by market share.

The transition to EVs caught many automakers off guard, and many are now paying for it. China’s auto market was first, but other key markets are expected to follow.