Ford’s third-quarter earnings, released Thursday, show growing EV losses as the automaker faces pricing pressure and slowing demand.

Third-quarter earnings preview

Ford sold 20,962 EVs in Q3, edging out Rival General Motors. The growth was thanks to rising Mustang Mach-E output.

Although Mach-E sales were down 20% through the first half of the year, Ford said it was due to a revamp at its plant in Mexico, where the model is built.

Mach-E sales rose 42.5% in the third quarter, with 14,842 units sold. The Mach-E set a new record with 5,872 models sold in September alone.

Meanwhile, sales of Ford’s electric pickup fell 46% in the quarter. Ford told Electrek last month that “F-150 Lightning production is starting to ramp after a six-week shutdown to expand the Rouge Electric Vehicle Center with limited deliveries across July and August.”

Despite this, Ford revealed plans to cut one of three shifts at the facility earlier this month. Ford denied the move was related to the ongoing UAW strikes, instead attributing it to “supply chain issues.”

Ford has introduced significant incentives on both the Mustang Mach-E and F-150 Lightning to stimulate demand.

Ford’s EV losses grow in Q3

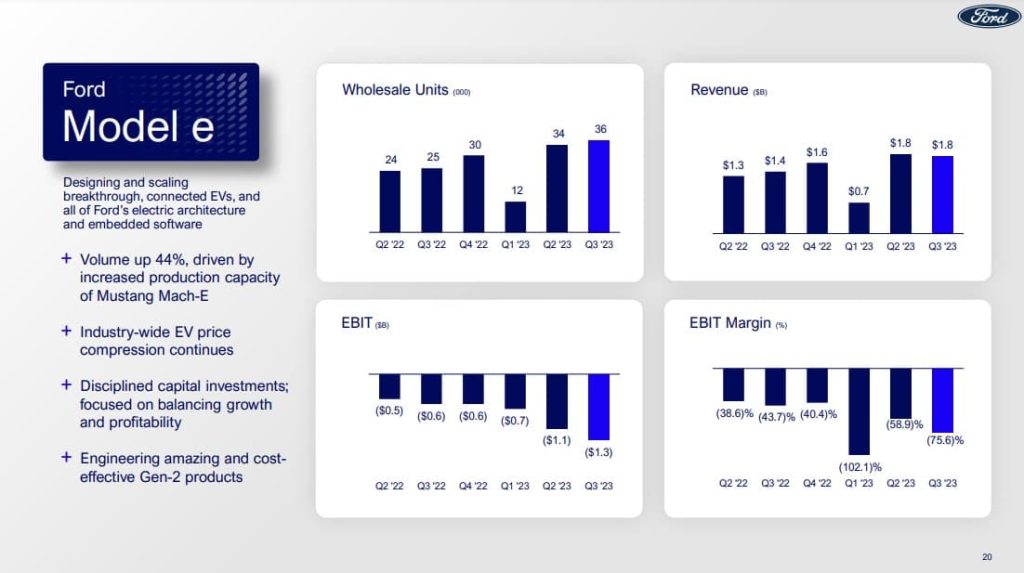

In the third quarter, Ford’s electric vehicle shipments increased by 44%. The higher volume contributed to Ford’s Model e unit’s revenue growing 26% YOY to $1.8 billion.

Despite higher volume, Ford’s EV losses continued to pile up in Q3. Ford posted an operating loss of $1.3 billion, up from $1.1 billion in Q3. Ford’s operating margins fell to -75.6% in the quarter from -58.9% in Q2. The company expects a full-year loss of $4.5 billion for its EV unit.

Ford lost around $36,000 for every EV sold in the quarter. According to the company, buyers are unwilling to pay a premium for their EVs over gas or hybrids, which is pressuring prices and profitability.

As a result, Ford is pushing back around $12 billion in planned investments to boost EV manufacturing capacity.

Ford is balancing demand with profits as it aims to keep up with Tesla, which has been cutting prices all year.

In response, Ford introduced a new “Flash” trim that will join the 2024 Lightning lineup. The 2024 F-150 Lightning Flash will start at around $70,000 with 320 miles range, a tech-loaded interior, and a heat pump. Ford says the Flash hits the “sweet spot” with features pulled from XLT and Lariat models.

Ford announced last quarter it would be pushing back its 600,000 EV run rate goal until next year, citing EV demand will be slower than expected.

Overall, Ford’s third-quarter revenue was up 11% to $44 billion. Due to the effects of the UAW strike and the tentative agreement met Wednesday, Ford is withdrawing its full-year guidance.

The move follows GM, who also withdrew full-year guidance following the UAW strike. GM also posted revenue of $44 billion on higher-margin pickup and SUV sales. The automaker announced it would be delaying production of the Equinox, Silverado RST, and GMC Sierra EVs by a few months.